If someone recommended getting your teenager a credit card, your first reaction might be to call them crazy. But maybe there’s something to it. Building good credit is a long and sometimes complicated process. Young adults ages 17 and 18 are signing off on five-digit student loans, young college students are looking to buy their first car with their first auto loan, and before you know it after graduation, the investment of buying a house is looming.

But if credit isn’t established before applying for auto loans, mortgages, or other financing, it could make approval near impossible. Here’s how making your teen an authorized user on your credit card can help them out in the long run.

Benefits

- Your teenager can inherit your credit score (check with your credit card on their reporting practices to make sure they report the account on the authorized user’s — your teen’s — credit report). Not only does this give them a head start in establishing a credit score, it also gives you another reason to keep your own score in tip-top shape! As an authorized user, your teen is not responsible for making payments, but if you make a late payment their credit history and score will suffer. On the flip side, if your teen overspends with the card, you may not be able to make your next payment, which is why a discussion about how and when to use the credit card is an important conversation!

- You can teach your teen how to use a credit card responsibly, how interest works, and how habits like delaying purchases and using a budget will help keep them out of credit card debt.

- By establishing a credit history as an authorized user of your card, your teen will be more likely to receive better interest rates for loans later in life or pre-approval offers from credit cards with better terms. And remember, establishing credit history is like establishing a verifiable identity in the world of credit and finance.

- A credit card gives your teen back-up access to funds in an emergency. They are also a safer form of currency in the event of theft as fraudulent charges are waived, but cash stolen is cash lost.

There are some steps you can take to prepare your teen for the responsibility of using a credit card, whether their own if they’re 18 or as an authorized user of your credit card.

How to Prepare

- Open a checking account with a debit card in their name. This will help your teen track cash flow and understand that money is limited (when their account is empty, their card won’t work, just like hitting a credit limit). They will also need a checking account when they are ready for their own credit card.

- Start with pre-paid cards such as a Visa® gift card. Like a debit card, it sets a mind-set of limited supply: when the card runs out, you can’t overbuy your way into debt. It can also help you monitor their spending.

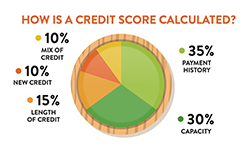

- Talk about how credit cards work. Explain interest rates, compound interest, principal, billing cycles, carrying over a balance from month to month, and the consequences of not paying a bill on time. Discuss how making minimum payments means paying more in the long run in interest, how debt adds up, and the importance of paying off the balance each month. Talk about the permanence of credit history, how a credit score is calculated, and how it impacts them throughout life. Don’t forget to talk about safe credit card use online.

- Decide from the beginning what types of charges your teen can put on the card. Then be sure to show them the balance each billing cycle, even if you’re making the payments and they only made acceptable purchases, so they understand how quickly the total adds up and what it would be like if they did have to pay it off. A good plan is to have them make regular, already-planned purchases on the card, like gas or groceries when they are out with you. If they make their own purchases with the card, just make sure they pay you back!

Of course, there are lots of things to consider before making the decision to give your teen a credit card. Every teen and family is different, so make the decision best for you.

How credit cards work and how to use them wisely shouldn’t be a mystery — for anyone! Talking to teens about responsible credit card use is a great lesson in financial education and responsibility.

Starting Your Credit Journey — For Ages 18 & Older

Members First Credit Union of Florida is here to lend a helping hand with your financial needs. Teens and young adults age 18 and older who are starting their credit journey can establish credit with the following options:

First Time Credit Card*

12.9% APR

- $750.00 Credit Limit

- Use at millions of locations that accept Visa® credit cards

- Earn rewards for your purchases

Secured Credit Card

- No credit history required — backed by a cash deposit you make when you open the account

- Credit limit that fits your budget

- Earn rewards for your purchases

* Members under the age of 21 must have a cosigner. Must be at least 18 to apply for a credit card if member can show proof of income. APR = Annual Percentage Rate. Rates and terms are based on individual credit worthiness. The method of computing finance charges (or interest) for purchases (including new purchase) is based on the Average Daily Balance. Rates are subject to change without notice. For our complete credit card disclosure, click here.

RESOURCES

« Return to "Blog" Go to main navigation