Strategies for Debt Repayment

Consumer debt is an extremely contradictory part of our personal finances: it's at once common and incredibly personal. According to numerous sources, the majority of US adults owe money in some way, shape or form—and yet what this consumer debt represents can vary drastically from person to person. To some, a debt might signify a major accomplishment or progress toward a large goal. To others, it might be a constant reminder of a time of crisis or hardship. The decisions that lead us to consumer debt can be thoughtful and deliberate, or rushed and misguided. It is perhaps these differences that make it challenging to talk openly about debt for fear of judgment.

No matter how unique one's debt situation is, there are some universal truths to borrowing money: it's expensive and it 'steals' money from your other life goals. Therefore, its repayment should be a top priority. Whether you're comfortably chipping away at a mortgage, dreading your monthly student loan payments or recovering from a credit card purchase you really couldn't afford, the following Dos and Don'ts provide some helpful tips that address and correct unhealthy attitudes surrounding debt.

DON'T pretend your debt doesn't exist

You can't solve a problem that you refuse to acknowledge. Ignoring your debt—either passively or actively—can lead to some financially devastating consequences. Allowing the stack of unopened mail on your kitchen counter to grow can lead to a missed payment or to late payment fees, which only increases your amount owing. Refusing to make any changes in your monthly budget is another form of willful blindness—in order to make significant progress on your debt repayment, you need to increase the amount you put toward your loans every month, either by increasing your income or decreasing your spending. Possibly the most financially destructive form of debt denial is spending even more to maintain the illusion of not being in debt. Going further into debt in order to finance a lifestyle you can't afford makes you fall further into the debt spiral.

DO tell someone about it

We're not saying it has to be your go-to icebreaker, but do consider talking about your debt with people you trust: your partner, your family, your close friends. Shame loves secrecy, and though it may feel uncomfortable at first, pushing through the fear of telling others will lessen the mix of guilt and anxiety that often accompanies debt shame. Being open about your financial priorities can also create a stronger accountability and support system—by simply telling others about your debt repayment goals, you no longer have to make those awkward excuses to duck out of meals and activities that are beyond your budget. You may also find that your honesty and your efforts inspire others to be more transparent about their own priorities and/or to make progress toward their financial goals.

DON'T prioritize savings and investing over high-interet debt repayment

A common question about debt repayment is where it falls in the order of financial operations. Is it more important than investing? Should it be paid off before you start saving for retirement? The specific answer will look different for someone paying an auto loan versus someone facing $10,000 of credit card debt, but there is a general rule of thumb that serves most debt profiles: high-interest debt repayment should come first. The reasoning is that high-interest debt (like credit card debt) is expensive. The sooner it's eliminated, the sooner you'll have extra funds to put toward savings, investments and retirement. Low-interest debt (like some mortgages) may be able to coexist with savings and investing contributions.

DO make room for emergency fund savings

Although high-interest debt repayment should come before general savings, you need to have an emergency fund in place. Three to six months' worth of expenses is the prescribed amount, but even a mini-fund of $1,000 will do the trick. It may seem counterintuitive to save up $1,000 that could otherwise be going toward your loans, but here's the rationale: when you're already in debt, there usually isn't much wiggle room in your budget. This means that all it takes is one emergency expense to force you into taking on more debt and wiping out your repayment progress. Having an emergency fund will decrease the likelihood of having to resort to more debt.

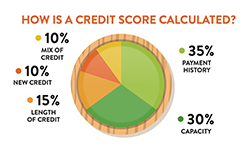

DON'T underestimate the consequences of debt

The financial consequences of debt paint only part of the picture—being in debt can take a toll on our health and our well-being. A 2012 University of Nottingham study found that those who struggle to pay off their debt are more than twice as likely to experience mental health problems like depression and severe anxiety. Debt stress can carry over into our relationships: arguments about money are considered one of the top predictors for divorce. Debt can also be emotionally overwhelming as a looming source of fear, resentment, frustration, regret and shame. Debt repayment is more than a simple financial goal—it's a health and wellness goal as well.

DO make a debt repayment plan

Luckily, the steps are pretty easy to follow:

- Start by making a list of all your debts—credit card, medical, students loans, etc. You'll need to know the balance you owe, the interest rate and the minimum payment for each debt.

- Total up your minimum payments, then define an additional amount of money to put toward loan repayment (choose an amount you can realistically afford, but don't be skimpy).

- Choose a repayment strategy to structure your plan. Popular strategies include:

- the Snowball method (sorting your debts from lowest balance to highest balance)

- the Avalanche method (sorting your debts from highest interest rate to lowest interest rate)

- Consolidation (taking out a new loan to pay off all your other debts, then repaying that one loan)

- the Snowball method (sorting your debts from lowest balance to highest balance)

- Using your repayment strategy as a guide, create a prioritized list of your debts.

- Each month, pay the minimum balance on all your loans except for the one at the top of your list—that one gets the minimum payment plus the additional funds you determined in Step 2.

That's it! As you sequentially pay off your debts, you'll have more money to apply to the next debt on the list. Debt repayment requires action, some discipline and a lot of patience. Having a plan helps track progress and keeps you from getting discouraged. If you need additional assistance in building your repayment plan, reach out to your local credit union for any debt-related resources they may have available for you.

Benefits of Consolidating Debt:

Reach your goals sooner than you think by combining your high-interest payments into one simple, low-interest payment.

Credit Card Debt

$2,000 at 20.63% APR

Auto Loan

$6,000 at 9.5% APR

Medical Bills

$4,000 with Late Fees

You consolidate your Credit Card, Auto Loan, and Medical Bills with a Debt Consolidation Loan, Home Equity Loan, or Balance Transfer. So you now owe the combined sum at a lower, APR that you can pay over time, bringing you one step closer to ditching your debt. Plus, you'll save in the long run by paying less in interest.

RESOURCES

We're here to lend a helping hand so you can take control of your debt.