Embarking on the journey to homeownership can be both exciting and daunting, especially for first-time buyers. With the right guidance and preparation, you can make informed decisions and find the perfect home that fits your needs and budget. Here's a comprehensive guide to help you spring into homeownership with confidence:

1. Assess Your Financial Health

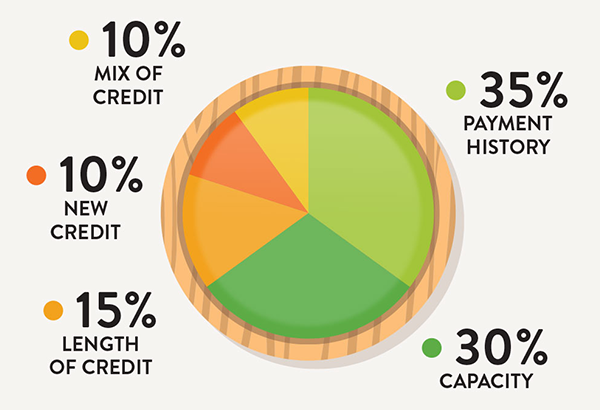

Begin by reviewing your financial situation. Check your credit score, assess your savings, and calculate your debt-to-income ratio. This will help you understand what you can afford and determine if you're financially ready to buy a home.

2. Set a Realistic Budget

Determine how much you can afford to spend on a home by considering your income, expenses, and financial goals. Remember to factor in costs like down payment, closing costs, and ongoing maintenance.

3. Explore Mortgage Options

Research various mortgage products available to first-time buyers. Consider consulting with a financial advisor or mortgage broker to understand the types of loans you qualify for, such as FHA, VA, or conventional mortgages.

4. Get Pre-Approved

Obtaining pre-approval from your Credit Union can strengthen your position as a serious buyer. Pre-approval will give you a clear understanding of your budget and show sellers that you are financially prepared to make an offer.

5. Find A Real Estate Agent

Work with an experienced real estate agent who understands the local market and can guide you through the homebuying process. An agent can help you find homes that match your criteria and negotiate the best deal.

6. Identify Your Needs and Wants

Make a list of features that are essential for your new home, such as location, size, and amenities. Prioritize your needs versus wants to help focus your search.

7. Start House Hunting

Begin visiting open houses and exploring neighborhoods to find the right fit. Pay attention to factors like commute times, schools, and community amenities.

8. Make an Offer

Once you find a home you love within your budget, work with your agent to make a competitive offer. Be prepared to negotiate with the seller to reach an agreement that works for both parties.

9. Conduct a Home Inspection

Schedule a professional home inspection to identify any potential issues with the property. This step is crucial to ensure the home is in good condition before finalizing the purchase.

10. Close the Deal

Review all documents carefully before signing. Ensure you understand the terms of your mortgage and any other agreements. Closing is the final step where ownership is transferred to you. Once you've closed, don't forget to take time to settle in, personalize your space, and enjoy the benefits of owning your own home.

By following these steps, first-time homebuyers can navigate the complexities of the homebuying process with greater ease and confidence. Remember, patience and preparation are key to finding a home that meets your needs and fits your budget. Happy house hunting!

We'll Lend A Helping Hand

We understand the process of purchasing your first home can be confusing or frustrating. That’s why we’re here to lend a helping hand with financial questions and concerns you may have. Give us a call at (850) 434-2211 or stop by a branch near you. If you’re ready, get pre-qualified today.

Rhonda Nelson

Mortgage Loan Manager

NMLS# 1119389

(850) 434-2211 Ext. 171

Email Rhonda

Mary Wade

Mortgage Loan Officer

NMLS# 490544

(850) 434-2211 Ext. 185

Email Mary

Amy Garrett

Mortgage Loan Processor

NMLS# 1470666

(850) 434-2211 Ext. 215

Email Amy

Is one of our Mortgage Team members busy or out of office? Email the Mortgage Group or call us (850) 434-2211 Ext. 842 and our next available team member will be there to assist you.

APR = Annual Percentage Rate. All loans are subject to credit approval. Rates and terms are based on individual credit worthiness. Terms and conditions apply. NCUA Insured. Equal Housing Lender. NMLS# 405711.

RESOURCES

« Return to "Blog"