Did you know, including debt from credit cards, mortgages, home equity loans, auto loans, student loans, and other household obligations, the average U.S. household has $90,000 - $150,000 in debt? It may feel like you're drowning in debt with no way out, but with patience, practice, and the right tools, you can free yourself from debt.

Tackling your credit card debt can be a major milestone for you on your journey to becoming debt-free. If you're serious about paying off your debt, it's likely you've done some research on ways to get out of debt and come across a balance transfer option. So, what is a balance transfer and how do they work?

Balance transfers can be a helpful financial tool to help you pay off your debt. Balance transfers are all about transferring a high-interest credit card balance to a low-interest credit card and have the potential to save you tons of money in the long run. If you're deciding if a balance transfer is the right option for you, you should:

Educate yourself on your debt

Balance transfers are most helpful for high-interest debt. Because of this, it's important for you to understand how much you owe in total. To do this, make a list of all your credit card accounts, including outstanding loans and add the annual percentage rate (APR) for each. Getting everything recorded will allow you to see it all at once and truly understand how much debt you have as well as the kinds of debt you have.

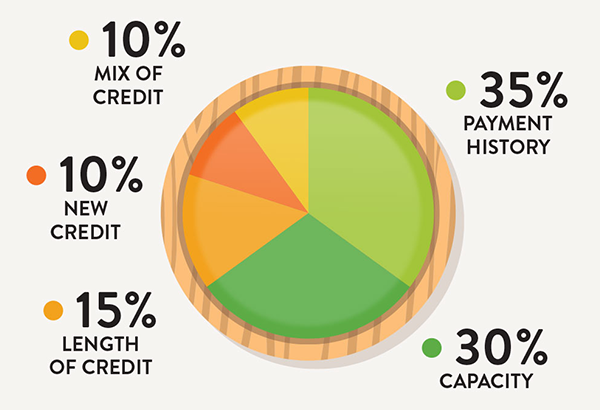

After you write everything down and do the math, you should get your latest credit score. Some credit card companies provide a FICO® Score snapshot with your account information. Another way is to access your credit report. You are entitled to a free copy of your credit report from each of the three major credit bureaus — Equifax, Experian, and TransUnion — once every twelve months.

Do more research

Once you've done the initial research to calculate your debt and review your credit, begin searching for balance transfer offers and compare the details. One way to do this is by researching online and keeping a detailed spreadsheet to store and compare all the different offers. While you're in the process of doing your research, keep the following in mind:

- APR: The APR or Annual Percentage Rate is a broad measure of the cost of borrowing money. When making a balance transfer you should note, of the promotional interest rate (if applicable) as well as the APR once the promotional period is over to see if it's worthwhile for you.

- Transfer fee: Some credit card companies or financial institutions charge a fee to make a balance transfer. The fee is usually a percentage of the total amount transferred — generally around 3-5%.

- Length of promotional APR offer: Credit companies will often offer a reduced interest rate for a certain length of time. Usually, promotional rates will range from 6 months to a year. Depending on the offer, it could be a great opportunity for you to make a balance transfer. Just remember to be aware of when the rate is set to increase so you can have your balance paid off before the promotional period ends.

- Which charges are subject to the low promotional rate: Depending on the program, some cards will honor the lower promotional rate on all new purchases along with your transferred balance, while others may charge a higher rate for purchases. While we don't recommend using your credit card while you're trying to pay the balance down, we understand that sometimes it's necessary. Do your research to see if charges are subject to the low promotional rate if you plan to use that credit card before the balance is paid in full.

- Annual fee: An annual fee is a yearly charge for the use of your credit card. Most card with annual fees have incredible rewards options, which may be right for you if you're paying your balance in full each month. However, when you're making a balance transfer, look for a credit card with no annual fee.

While researching new credit cards for balance transfer offers, it's important to understand how a balance transfer will affect your credit. Balance transfers will not hurt your credit score directly, but applying for a new card to complete your balance transfer could affect your credit both positively and negatively:

- The negative: Applying for a new credit card to transfer your balance results in a hard inquiry on your credit report and will take a few points off your score initially, and it will stay on your credit report for up to two years. Also, opening a new card affects the length of credit history. A new credit account can reduce the average age of your credit, which can shave a few points off your score.

- The positive: Performing a balance transfer will not affect your credit score much. The key to improving your credit score is to use the balance transfer as a tool to reduce debt. Think of it this way, every dollar that you don't pay in interest is a dollar that you can instead use to pay down your debt. And, because payment history and capacity are worth more when calculating your credit score, eliminating debt will send the kind of signals that result in a better credit score. In the long run, using a balance transfer to pay down your debt and use credit responsibly going forward outweighs the short term hits to your credit score.

Compare, choose, then apply

Once you've compared all the options and choose the offer that best fits your needs, find out what the application process is and apply.

Follow instructions for the balance transfer

Once you're approved, review the balance transfer process for the card you want to transfer your balance(s) to. Gather all the account information for the card(s) you are transferring the balance from and the exact amount you want to transfer to the new card. Follow any other steps required and make sure the credit card(s) you are transferring the balance from is paid and everything is settled.

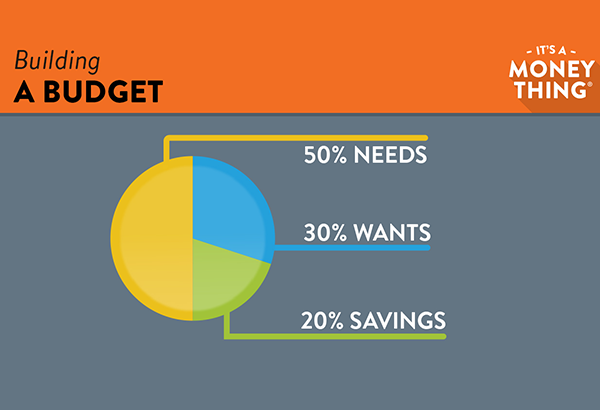

Create and execute a plan to pay off your debt

Balance transfers can be a powerful tool when used wisely. Make the most of your low interest rate by working this debt into your budget. Create a solid plan to pay the debt off in full before the promotional period ends. Once the balance is paid off, avoid the urge to charge it up again — make payments on new purchases in full and on time.

Is a Balance Transfer on Your To-do List?

We'll lend a helping hand with this limited time offer:

Stop Weighing Your Options

Balance Your Finances With Our Limited Time

2.99% APR*

Balance Transfer Offer.

*APR = Annual Percentage Rate. 2.99% Annual Percentage Rate for the first 6 billing cycles on balance transfer, after 6 billing cycles card balance will revert to standard card rate. Additional limitations, terms, and conditions may apply. Availability of offer based on credithworthiness. Please contact a Members First Credit Union of Florida representative for specific terms and conditions. Offer expires 12/31/2022.

RESOURCES

« Return to "Blog"