Whether you're buying a home or refinancing your current mortgage, it's a good idea to understand what affects mortgage rates so you can make the best decision for you.

Mortgage rates are dependent on several factors that include things you can control like your credit score, the type of home loan (Conventional, FHA, VA, etc.), down payment, the loan term, and/or the type of interest rate (fixed rate or adjustable-rate mortgage).

Mortgage rates are also dependent on factors that you can't control, such as the economy. Some of the economic factors that could affect your mortgage rate are economic growth, inflation, housing market conditions, and monetary policy.

Interest rates are an important part of making an informed decision when buying or refinancing your home and with rates on the rise, now could be the perfect time to secure a lower rate on your home loan. What else should you consider before you refinance or purchase your home? We're sharing:

1. When to Refinance Your Home

If you have been in your home for five years or more, and have equity built up, you may be thinking about refinancing. Refinancing your home can be beneficial if:

- You can reduce your interest rate by 1% or more. A 1% cut in your interest rate can save you thousands of dollars in the long-term. For example: If you have a 15-year, mortgage of $150,000 with a 5% interest rate, it will amass about $63,000 in interest over the life of your loan. If you compare that to $49,700 in interest at 4% on the same home after refinancing, you'll be saving about $13,800 in interest payments.

- You need more wiggle room in your monthly budget. A shift in your personal life like paying for medical bills or sending your kids to college can impact your budget. Refinancing your home loan can lower both your interest rate and your monthly home loan payment giving you the ability to finance your more immediate needs.

- You can make the switch from an adjustable-rate mortgage (ARM) to a fixed rate mortgage. If the rate on your ARM is close to increasing, it's a good time to secure a fixed rate. Not only will you continue to save, but you'll also gain the benefit of having predictable, monthly payments.

Refinancing? You'll need to provide the following during the refinance process:

- A copy of your deed

- Two years of W-2 forms (for each borrower) or 2 years of tax returns

- One month of pay stubs (for each borrower)

- Payoff balance of your current mortgage

- Proof of assets

2. Assets Homebuyers Should Have

Whether you're new to the home-buying process or are planning to upgrade to a larger home for your growing family, having the following assets before you begin your house hunt will help make the home-buying process go smoothly:

- A steady income. Proof of a steady, reliable income shows the lender your ability to afford a monthly mortgage payment and you are a low risk for defaulting on a loan. Typically, lenders want to see a work history of at least two years at your current employer or in your current field of work. If you're self-employed, you may be required to show a longer length of work history.

- Low debt-to-income ratio. Lenders will look at the ratio of your monthly debt obligations (student loans, car loan, credit card balances, personal loans, etc.) and compare it to your gross annual income — also known as your debt-to-income ratio. Keeping this ratio as low as possible will show that you're able to afford your mortgage payment along with your other monthly expenses.

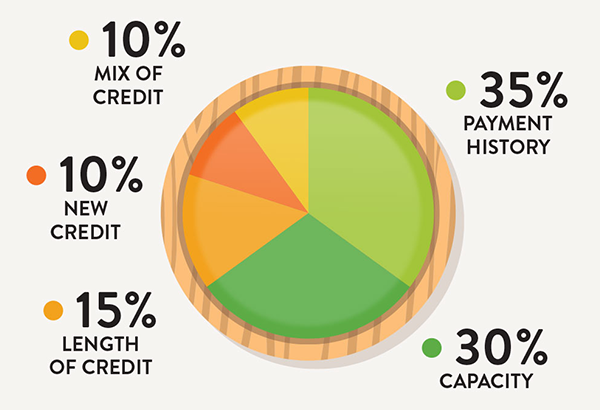

- A good credit score. Your credit score is the primary way lenders gauge how well you've managed your credit, loans, and debt in the past. Scores fall on a scale of 300-850. While a credit score of 670-739 is considered good, applicants with a score of 740 or higher are most likely to receive better than average rates from lenders.

- Cash for a down payment. The money you plan to spend as your down payment should be in the form of cash that you can easily access (not a CD or share savings account with withdrawal fees). It can be tempting to put all or part of the down payment on a credit card, but this will affect your debt-to-income ratio, ultimately lowering your credithworthiness.

- Cash for closing costs. It's smart to allocate some of the money you've saved up as cash for paying closing costs. Closing costs include loan origination fee, title search and recording fee, appraisal fee, inspection fee, property taxes, and more. While these costs vary, they typically fall between 2% and 5% of a home's purchase price.

Members First Credit Union of Florida's Home Loan Programs

We'll lend a helping hand to make your dream of home ownership a reality or help you pay off your mortgage quickly with the right mortgage refinance program for you.

RESOURCES

APR = Annual Percentage Rate. All loans are subject to credit approval. Rates and terms are based on individual credit worthiness. Terms and conditions apply. NCUA Insured. Equal Housing Lender. NMLS# 405711.

« Return to "Blog"