When it comes to money, timing matters. If the timing of your income doesn't align with the timing of your expenses, you may come up short if you don't plan in advance. That's why, sometimes, monthly budgets don't work out from week to week. We'll help you understand your cash flow by looking at how money flows in and out of your household, so you can create a cash flow budget that works for you.

What is a Cash Flow Budget?

A cash flow budget projects what money you expect to come in and how much you think you'll spend each week and when you expect the expenses to occur. It's different from a regular budget because it breaks your monthly budget down week by week. It accounts for when money and other financial resources are expected and when they have to be used on needs, wants, and obligations. A cash flow budget is particularly important for people who have irregular, seasonal, or one-time income because it can help you plan ways to spread the income you receive over the future weeks or months when you don't have money coming in.

Analyzing Your Cash Flow

Before you can create a cash flow budget, you will need to track your income, resources, and expenses for at least one month. Take a look at your total income and benefits and your total expenses for each week. Do you have enough to cover all of your expenses each week? Are there things you can adjust or postpone so that you have enough to cover your needs each week? If you find yourself short on funds, brainstorm strategies for how to keep your cash flow positive each week. This may mean cutting expenses or changing the timing for when some of your expenses happen.

Note: There are some expenses, commonly called fixed expenses, like rent or your car payment, that you can't easily reduce. Cutting back on these types of expenses require major changes, like moving or selling your car. Sometimes, however, you can work with your landlord or lender to adjust when the bill is due, which can improve your cash flow. For instance, can you pay your rent on the fifth of the month or even split your payment into two smaller ones, due on the first and the fifteenth of the month?

Creating a Cash Flow Budget

Your cash flow budget is about setting targets for how and when you will spend your income going forward. It's important to be realistic when you set targets and focus on the things that you have control to change. Remember before you begin, you'll need to track your income, resources, and expenses for at least a month.

Getting Started

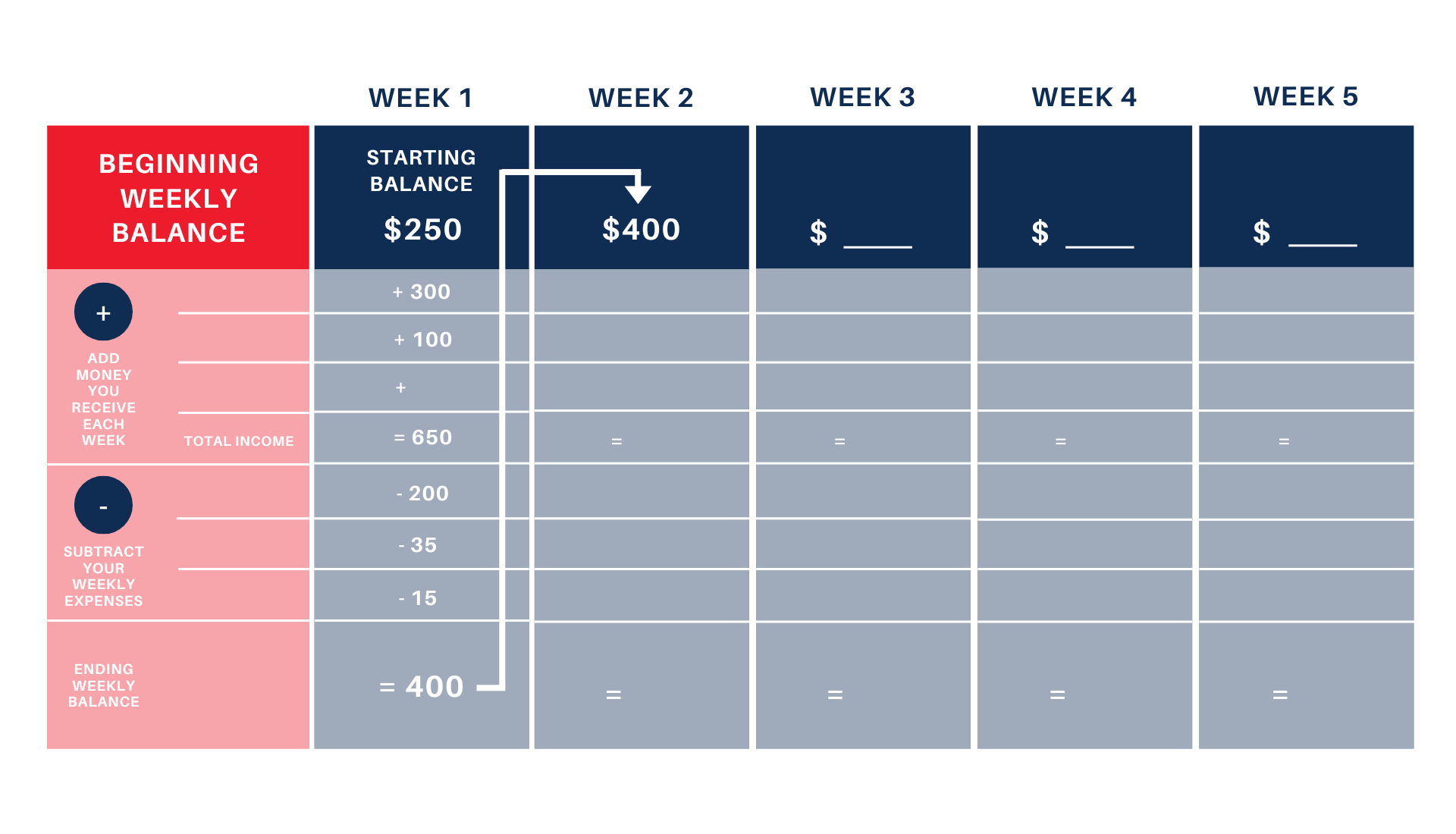

- Enter your beginning balance for the week.

- Add all of the income and benefits you receive that week. Subtract all of your expenses for that week. Include the money you spend on everyday expenses, bills, and savings. Also include benefits you use to pay for things that would otherwise be paid for with cash, such as SNAP and TANF.

- What's left is your ending balance. If it's positive, you have enough income and benefits to make it through the week. If it's negative, you're falling short.

- Make note of your ending balance for the week and use it as your beginning balance of the next week. Repeat these steps for the rest of the weeks that month.

A Certified Credit Counselor is Here to Lend A Helping Hand

If you'd like to learn more about making a cash flow budget, need assistance analyzing your budget, or would like to get one-on-one consultation with a certified credit counselor to work through debt crisis or address life-changing financial matters, a representative from the University of West Florida Louis Maygarden Center for Financial Literacy is available for appointments at our Members First Credit Union of Florida branch on Nine Mile Rd.

Source: Consumer Financial Protection Bureau

« Return to "Blog"