Buying your first home is a major milestone—and while it can feel overwhelming, it doesn’t have to be. At Members First Credit Union of Florida, we're here to help you navigate the journey with confidence. Whether you're just starting to dream or ready to make an offer, this guide breaks down the process into manageable steps.

Step 1: Know Where You Stand Financially

Before you start browsing listings, take a close look at your finances:

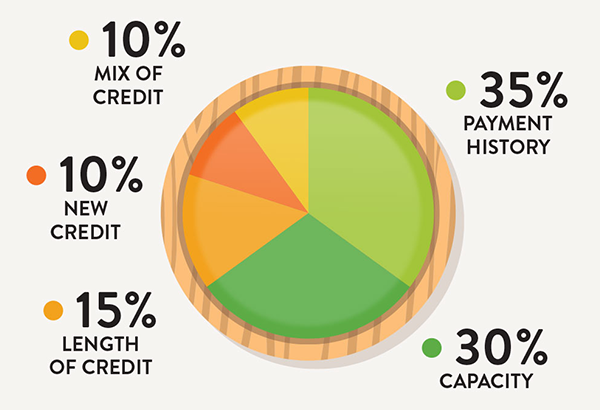

- Check your credit score and review your credit report for accuracy.

- Determine your budget by factoring in your income, monthly expenses, and existing debts.

- Save for upfront costs like your down payment, closing costs, inspections, and moving expenses.

Tip: Members First offers tools and resources to help you assess your financial fitness. Ask us about our Credit Health Review!

Step 2: Get Pre-Approved for a MortgageGetting pre-approved shows sellers you’re serious and gives you a clear idea of what you can afford. Our in-house mortgage options—including our 5-Year ARM loan—are designed to fit your needs.

Bonus: First-time home buyers who finance with us may qualify for up to $2,500 toward closing costs!

Step 3: Define Your Home GoalsThink about what matters most to you:

- Location and commute time

- Number of bedrooms and bathrooms

- School districts and nearby amenities

- Long-term value and resale potential

Step 4: Partner with a Real Estate Agent

A trusted agent can help you find the right home, negotiate offers, and handle the paperwork. Ask friends or family for recommendations, or let us connect you with local professionals.

Step 5: Start House Hunting

This is the fun part! Attend open houses, schedule showings, and compare homes. Keep your priorities in mind, but stay flexible—your dream home might surprise you.

Step 6: Make an Offer

Once you've found the right home, your agent will help you submit a competitive offer. Be prepared for negotiations and stay within your budget.

Step 7: Schedule Inspections and Appraisal

A home inspection ensures the property is in good condition, while an appraisal confirms its market value. These steps protect your investment and your loan.

Step 8: Finalize Your Mortgage

Submit your final documents, review your loan terms, and prepare for closing. Our mortgage team will guide you every step of the way.

Step 9: Close and Celebrate!

At closing, you'll sign the paperwork, pay any remaining costs, and receive your keys. Congratulations—you're officially a homeowner!

Ready to Begin?

Members First Credit Union of Florida is here to support you with personalized guidance, competitive mortgage options, and exclusive first-time buyer benefits. Let's make your homeownership dream a reality.

Contact us today to schedule a consultation or learn more about our mortgage programs. Give us a call at (850) 434-2211 or stop by one of our branch locations. You can also contact one of our Mortgage Team members below.

Rhonda Nelson

Mortgage Loan Manager

NMLS# 1119389

(850) 434-2211 Ext. 171

Email Rhonda

Mary Wade

Mortgage Loan Officer

NMLS# 490544

(850) 434-2211 Ext. 185

Email Mary

Amy Garrett

Mortgage Loan Processor

NMLS# 1470666

(850) 434-2211 Ext. 215

Email Amy

Is one of our Mortgage Team members busy or out of office? Email the Mortgage Group or call us (850) 434-2211 Ext. 842 and our next available team member will be there to assist you.

APR = Annual Percentage Rate. All loans are subject to credit approval. Rates and terms are based on individual credit worthiness. Terms and conditions apply. NCUA Insured. Equal Housing Lender. NMLS# 405711.

RESOURCES

« Return to "Blog"