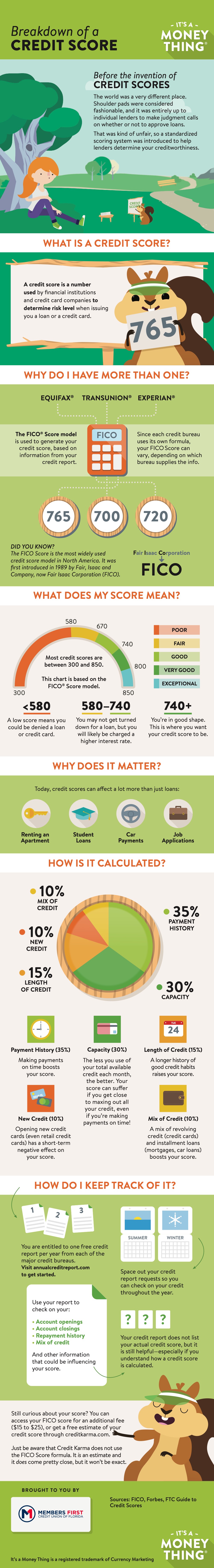

Before the invention of credit scores

The world was a very different place. Shoulder pads were considered fashionable, and it was entirely up to individual lenders to make judgment calls on whether or not to approve loans. That was kind of unfair, so a standardized scoring system was introduced to help lenders determine your creditworthiness.

What is a credit score?

A credit score is a number used by financial institutions and credit card companies to determine risk level when issuing you a loan or a credit card.

Why do I have more than one?

The FICO® Score model is used to generate your credit score, based on information from your credit report. Since each credit bureau uses its own formula, your FICO score can vary, depending on which bureau supplies the info.

Did you know?

The FICO score is the most widely used credit score model in North America. It was first introduced in 1989 by Fair, Isaac and Company, now Fair Isaac Corporation (FICO).

What does my score mean?

Most credit scores are between 300 and 850. This chart is based on the FICO Score model.

- Less than 580: A low score means you could be denied a loan or credit card.

- 580-740: You may not get turned down for a loan, but you will likely be charged a higher interest rate.

- 740+: You’re in good shape. This is where you want your credit score to be.

Why does it matter?

Today, credit scores can affect a lot more than just loans:

- Renting an apartment

- Student loans

- Car payments

- Job applications

How is it calculated?

Today, credit scores can affect a lot more than just loans:

- Payment History (35%): Making payments on time boosts your score.

- Capacity (30%): The less you use of your total available credit each month, the better. Your score can suffer if you get close to maxing out all your credit, even if you're making payments on time!

- Length of Credit (15%): A longer history of good credit habits raises your score.

- New Credit (10%): Opening new credit cards (even retail credit cards) has a short-term negative effect on your score.

- Mix of Credit (10%): A mix of revolving credit (credit cards) and installment loans (mortgages, car loans) boosts your score.

How do I keep track of it?

- You are entitled to one free credit report per year from each of the major credit bureaus.

- Visit annualcreditreport.com to get started.

- Space out your credit report requests so you can check on your credit throughout the year.

- Use your report to check on your:

- Account openings

- Account closings

- Repayment history

- Mix of credit

- And other information that could be influencing your score

- Your credit report does not list your actual credit score, but it is still helpful—especially if you understand how a credit score is calculated.

Still curious about your score? You can access your FICO score for an additional fee ($15 to $25), or get a free estimate of your credit score through creditkarma.com. Just be aware that Credit Karma does not use the FICO formula. It is an estimate and it does come pretty close, but it won’t be exact.

We'll Lend A Helping Hand

For questions or information on how you can improve your credit score, call us at (850) 434-2211 and select option 2 to speak with a representative in our Loan Department or stop by a branch.

Sources: FICO, Forbes, FTC Guide to Credit Scores

« Return to "Financial Education Center"