Home > Tools & Resources > Boost Your Credit Score: How Long Does Information Stay On My Credit Report?

Boost Your Credit Score: How Long Does Information Stay On My Credit Report?

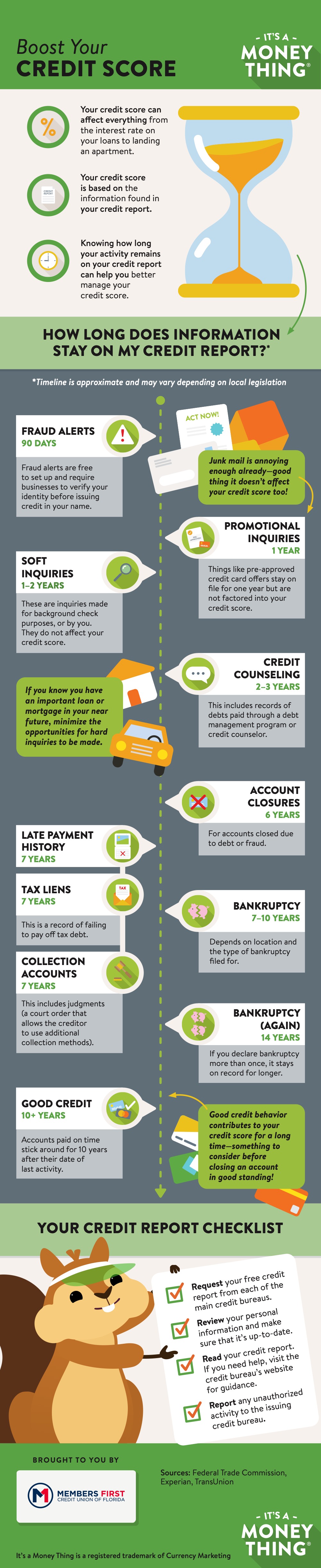

- Your credit score can affect everything from the interest rate on your loans to landing an apartment.

- Your credit score is based on the information found in your credit report.

- Knowing how long your activitiy remains on your credit report can help you better manage your credit score.

How long does information stay on my credit report?*

*Timeline is approximate and may vary depending on local legislation.

- Fraud alerts (90 days): Fraud alerts are free to set up and require businesses to verify your identity before issuing credit in your name.

- Promotional inquiries (1 year): Things like pre-approved credit card offers stay on file for one year but are not factored into your credit score.

- Soft inquiries (1-2 years): These are inquiries made for background check purposes, or by you. They do not affect your credit score.

- Credit counseling (2-3 years): This includes records of debts paid through a debt management program or credit counselor.

- Hard inquiries (6 years): Made by other lenders or businesses; many inquiries in a short amount of time can lower your score.

- Bad checks (6 years): Records of non-sufficient funds are kept for 6 years.

- Account closures (6 years): For accounts closed due to debt or fraud.

- Late payment history (7 years)

- Tax liens (7 years): This includes judgments (a court order that allows the creditor to use additional collection methods).

- Bankruptcy (7-10 years): Depends on location and the type of bankruptcy filed for.

- Good credit (10+ years): Accounts paid on time stick around for 10 years after their date of last activity.

- Bankruptcy again (14 years): If you declare bankruptcy more than once, it stays on record for longer.

Your credit report checklist

- Request your free credit report from each of the main credit bureaus.

- Review your personal information and make sure that it’s up-to-date.

- Read your credit report. If you need help, visit the credit bureau’s website for guidance.

- Report any unauthorized activity to the issuing credit bureau.

Sources: Federal Trade Commission, Experian, TransUnion, LearnVest Planning Services

We'll Lend A Helping Hand

For questions or information on how you can improve your credit score, call us at (850) 434-2211 and select option 2 to speak with a representative in our Loan Department or stop by a branch.

« Return to "Financial Education Center"