My Cards

MANAGE YOUR CARD ON YOUR TERMS.

Ready for an easier way to manage your cards? Manage your Members First Credit Union of Florida debit or credit card with our upgraded card experience — putting more control, convenience, and safety in your hands. From instant card activations to clearer merchant transaction information to robust fraud protections, now you can do even more from the convenience of Internet Banking and our Mobile Banking app.

Control

Turn your card(s) on/off at your discretion, set spending limits, create travel plan notifications, and more.

Convenience

Enjoy 24/7 access to your cards, activate cards, gain deeper insights into spending, and more.

Safety

Report lost or stolen cards and immediately turn off a lost or stolen card.

My Cards Features & Benefits

Navigate to 'My Cards' on Internet Banking or the Members First Mobile app to take control of your Members First debit and/or credit card(s) and enjoy the following features:

- Turn your cards on/off at your discretion

- Know where every card is stored online

- Set spending limits based on location, amount, merchant type, and transaction type

- Create travel plan notifications

- Activate cards with ease

- Keep track of spending with a glance

- Report lost or stolen cards in a couple of clicks

- Immediately turn off a lost or stolen card

GET STARTED

To begin managing your cards, you must first be enrolled in internet banking. Register for internet banking today if you are not already enrolled. Once you're registered, you can begin managing your cards by navigating to 'My Cards' in Internet Banking or our mobile banking app.

Download the Mobile App For 24/7 Access To Your Finances

Note: You must enroll for Internet Banking before you begin using the mobile app. Learn how to get started here. To enroll for Internet Banking from the Members First Credit Union of Florida Mobile App, open the app and tap 'Sign up' on the links bar found on the bottom of the app's home screen.

Members First Credit Union of Florida offers our Mobile App free of charge. However, message and data rates may apply. Charges are dependent on your service plan which may include fees from your carrier. Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google Inc.

FREQUENTLY ASKED QUESTIONS (FAQ)

Have questions about the My Cards card management features and how to use them? We've answered a few frequently asked questions below.

1. What is My Cards?

My Cards is our robust card management center that resides within Members First Credit Union of Florida's internet banking platform and mobile banking app.

2. What type of card(s) can I manage with My Cards?

Manage your Members First debit or credit card with ease by navigating to 'My Cards' in Internet Banking or the Members First mobile app.

3. What features and benefits are available to me with My Cards?

Our upgraded card experience puts more control, convenience, and safety in your hands. With our card management center, you'll be able to:

- Turn your cards on/off at your discretion.

- Know where every card is stored online.

- Set spending limits based on location, amount, merchant type, and transaction type.

- Create travel plan notifications to let us know when you'll be traveling to ensure your cards keep working without interruption.

- Easily add cards to your digital wallets.

- Access card credentials without needing your physical card.

- Activate cards with ease.

- Gain total transparency into every transaction with clear merchant names.

- Keep track of spending with a glance.

- View merchant name, logo, exact location on map, and contact information.

- Contact merchants directly based on transactions. View spend by what, when, and where.

- Report lost or stolen cards in a couple of clicks.

- Immediately turn off a lost or stolen card.

4. How do I manage my cards?

In order for you to be able to manage your Members First card, you must be enrolled in Members First Credit Union of Florida's internet banking. Once you're enrolled, you can start to manage your card within internet banking or our mobile banking app by navigating to 'My Cards'.

1. How do I get started?

To begin managing your Members First cards, make sure you're enrolled in Internet Banking. Once you're enrolled, you'll be able to manage your cards after you login to Internet Banking on your computer or with our mobile app by navigating to 'My Cards'.

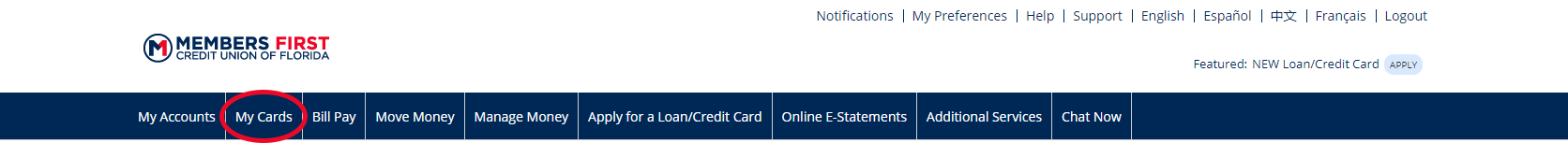

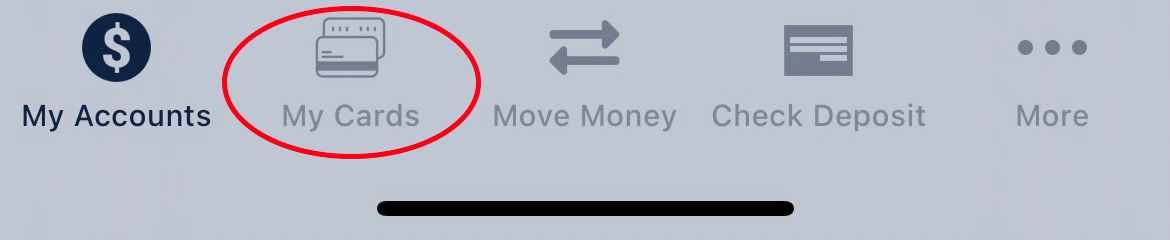

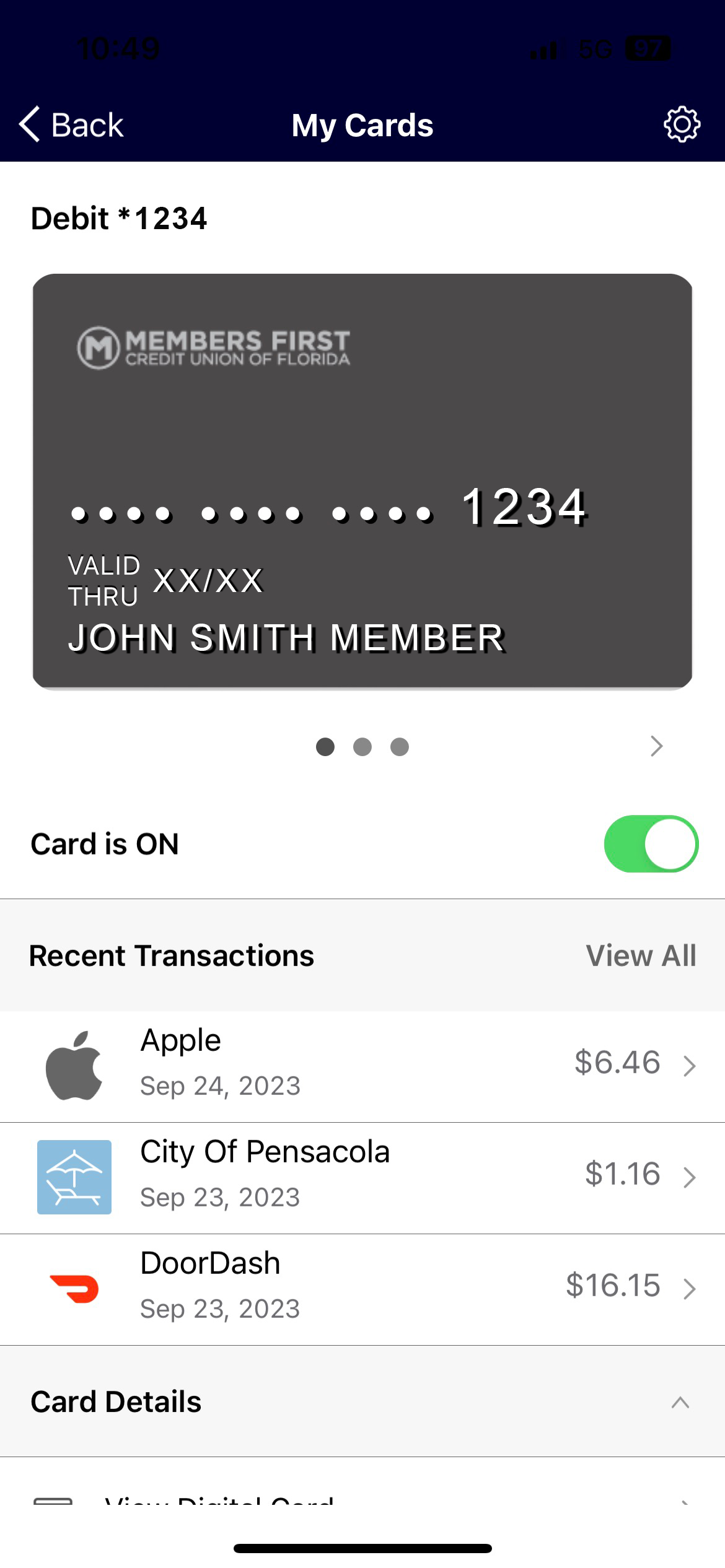

On Desktop:

On Mobile:

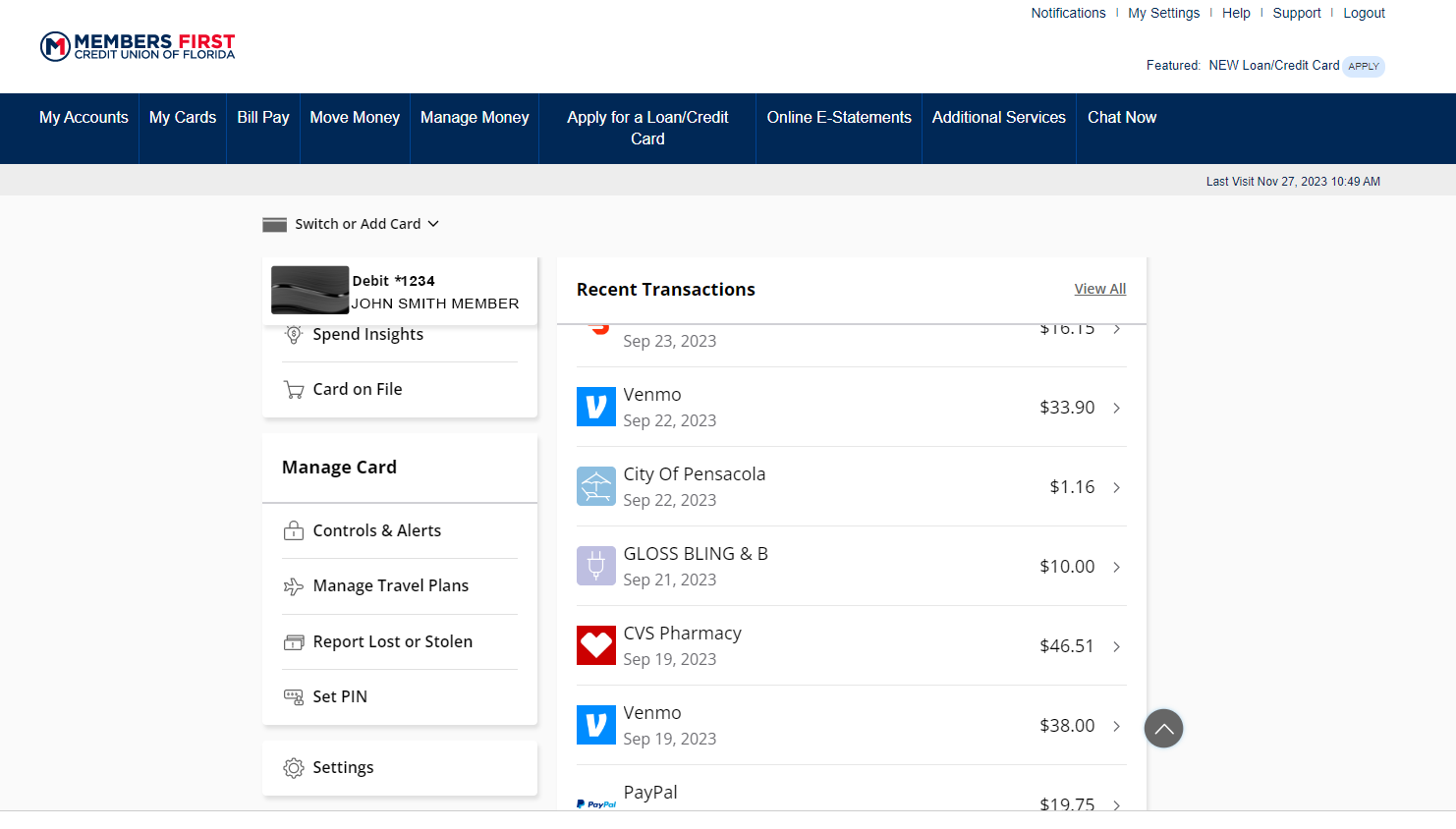

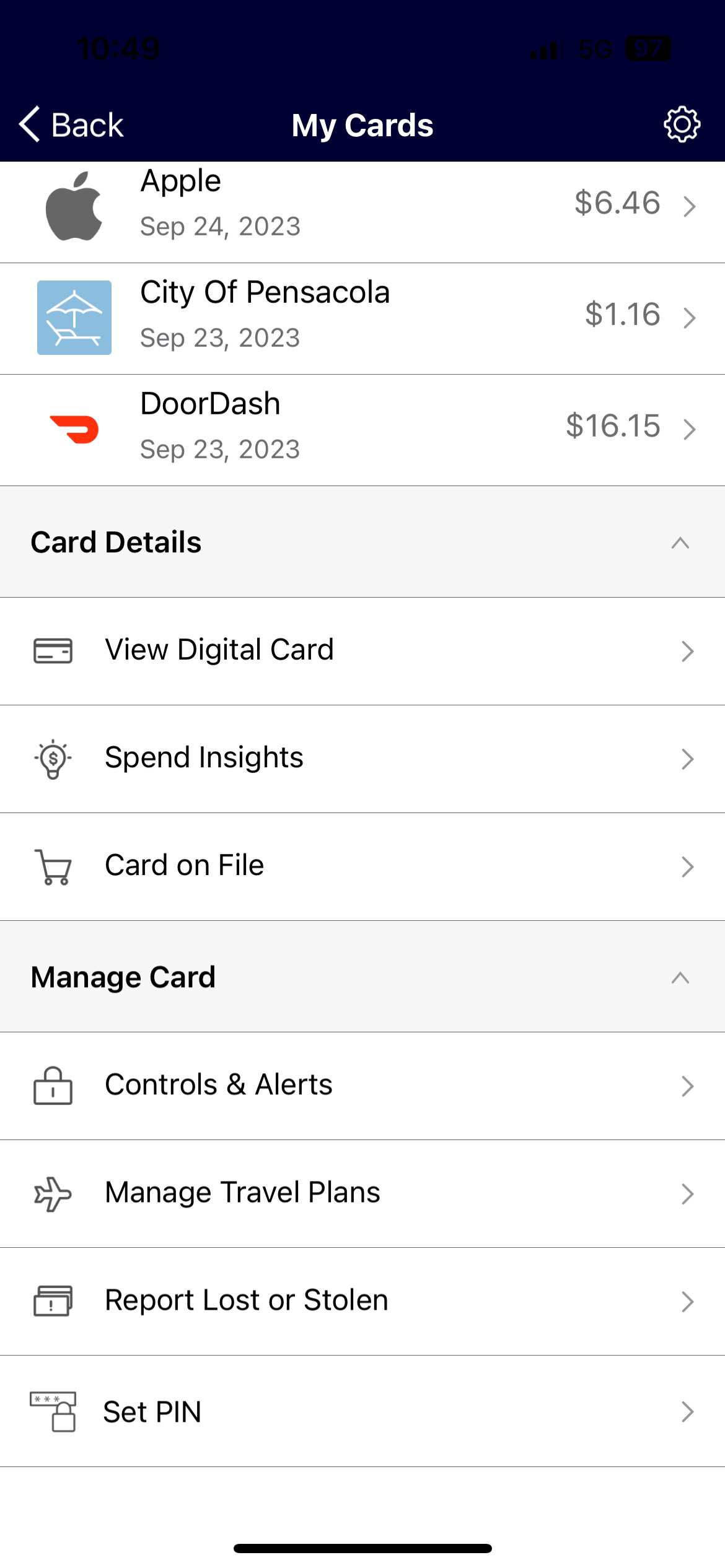

From the 'My Cards' tab, you'll be able to view transactions, activate a new card, set controls and alerts, manage travel plans, report a lost or stolen card, view your digital card, and more.

On Desktop:

On Mobile:

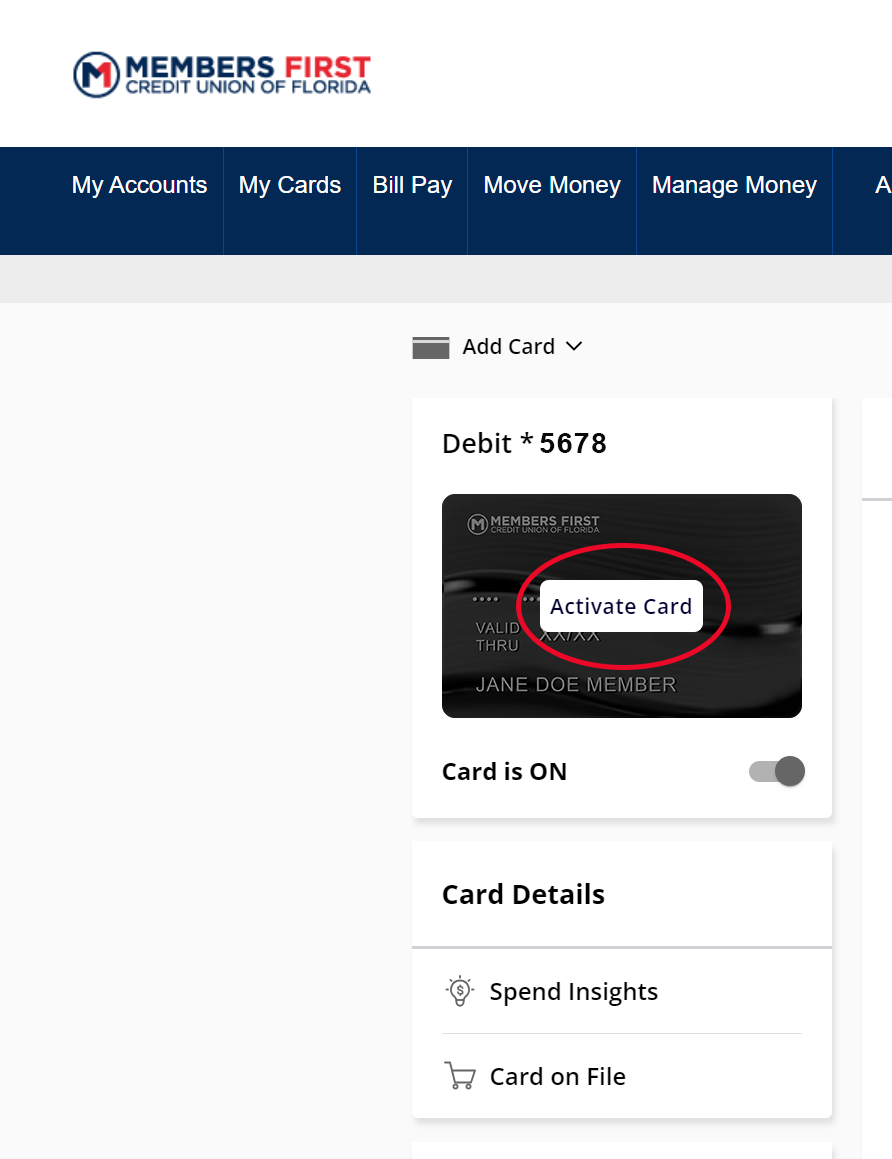

2. How do I activate my card?

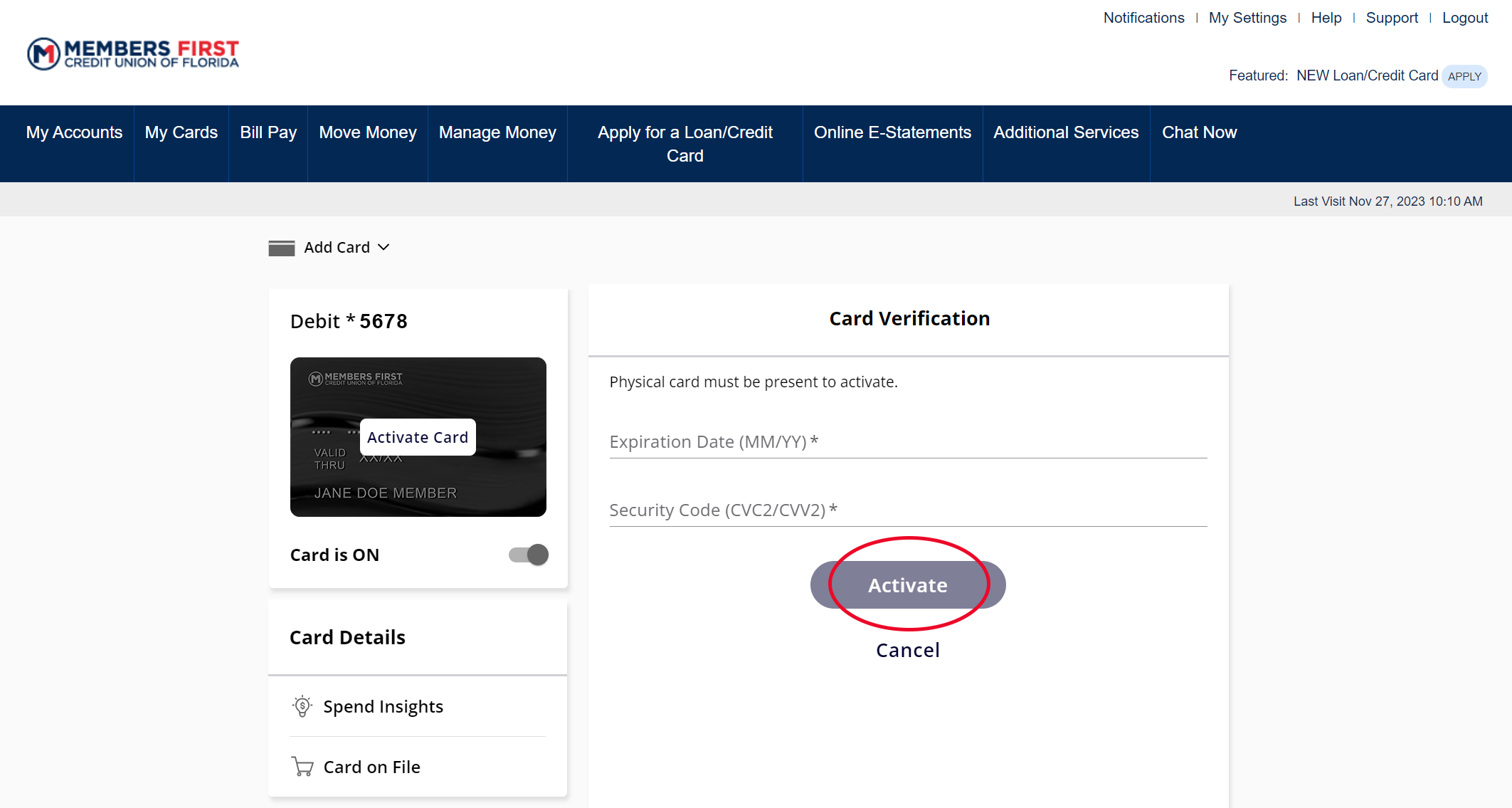

Activating your card is easy. Click or tap 'activate card' and follow the prompts to begin activation.

Verify your card information by entering your card's expiration date and security code(CVC/CVV). Then, click or tap 'activate'.

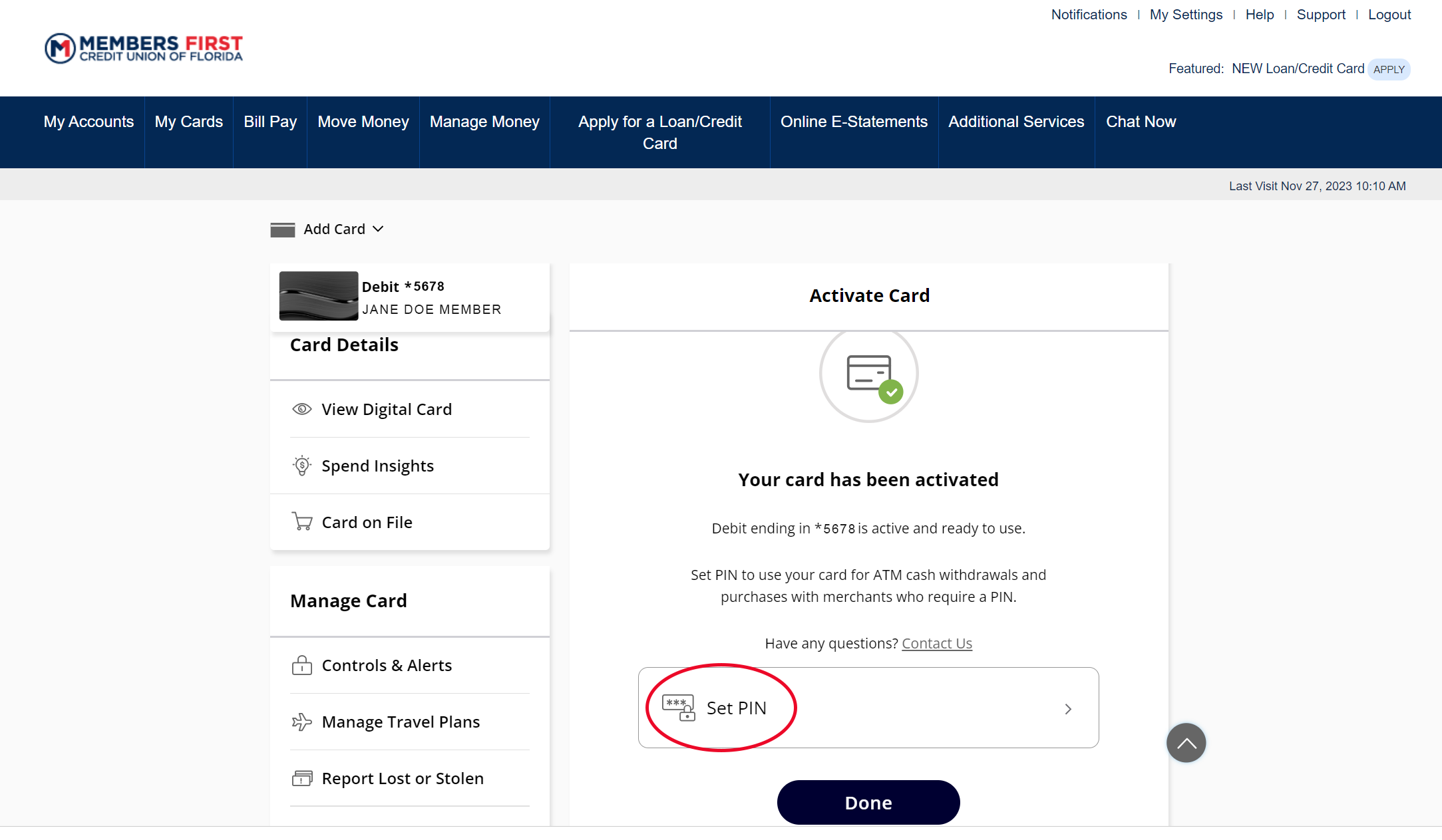

Once your card is activated, you can choose 'done' or set a PIN for your card.

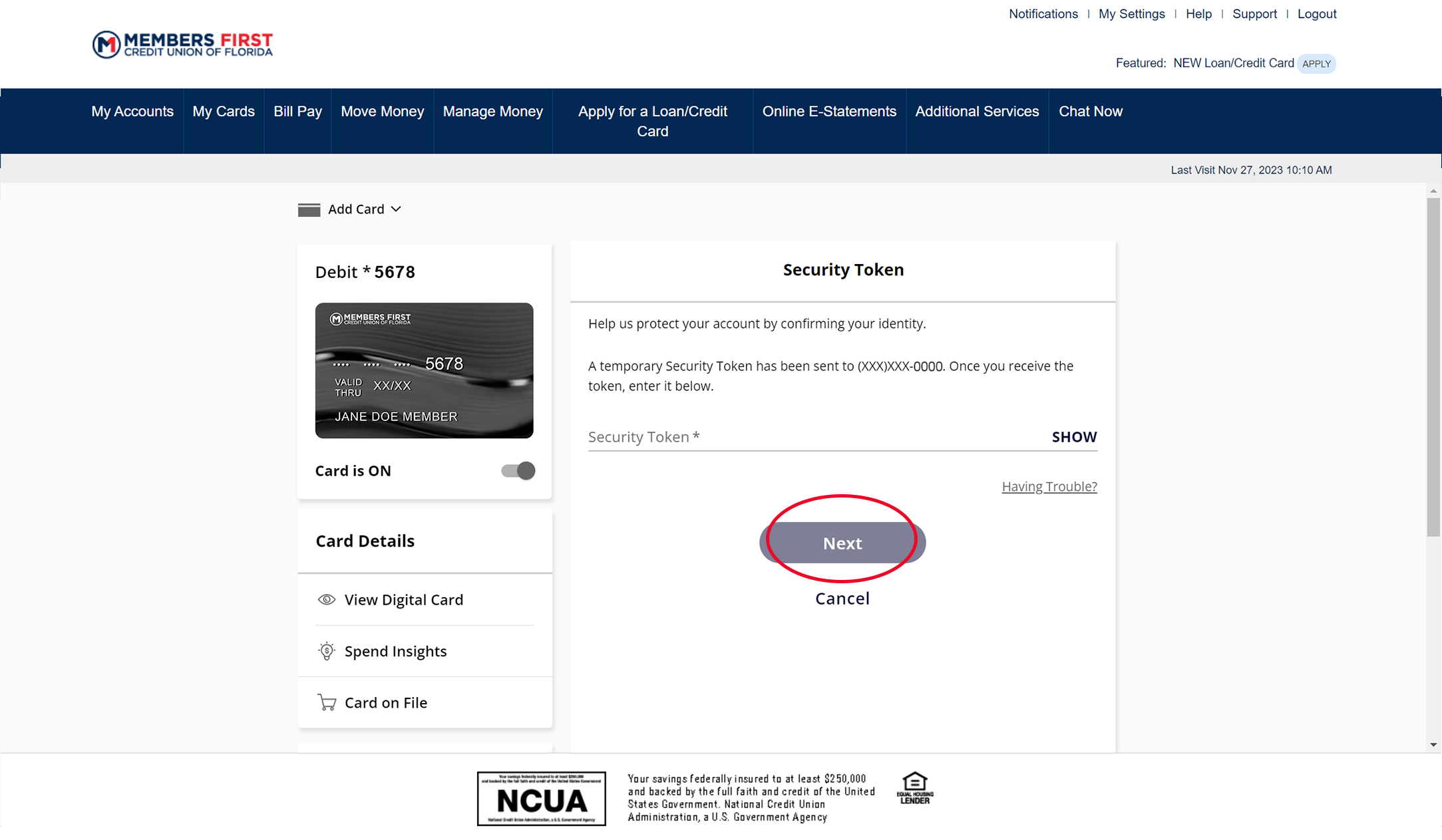

If you choose to set a PIN for your card, a temporary security token will be sent to you. Enter the security token to create your PIN. Then, click or tap 'next'.

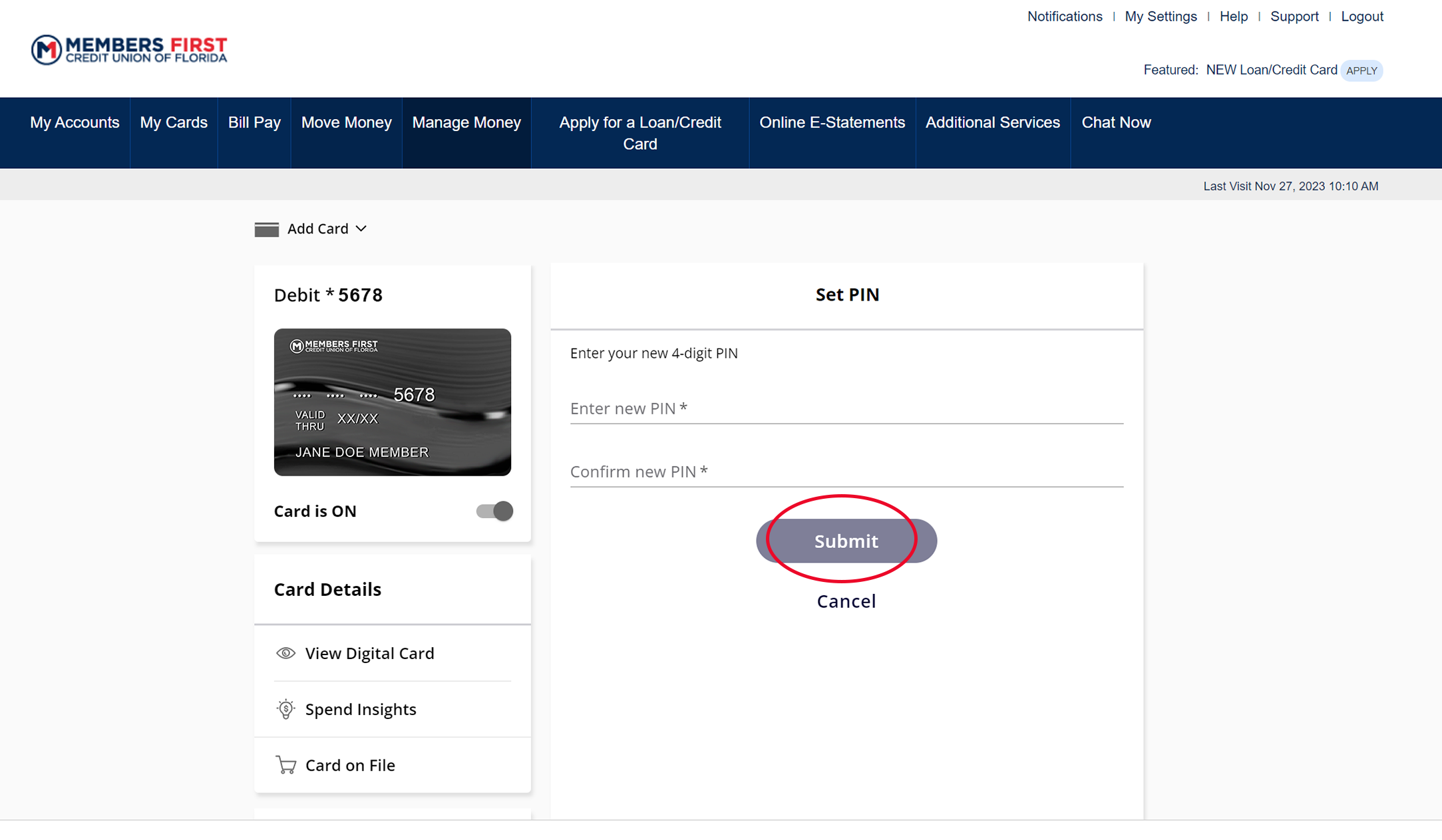

You'll then be prompted to create your desired PIN. After you enter your new 4-digit PIN twice, tap or click 'submit'.

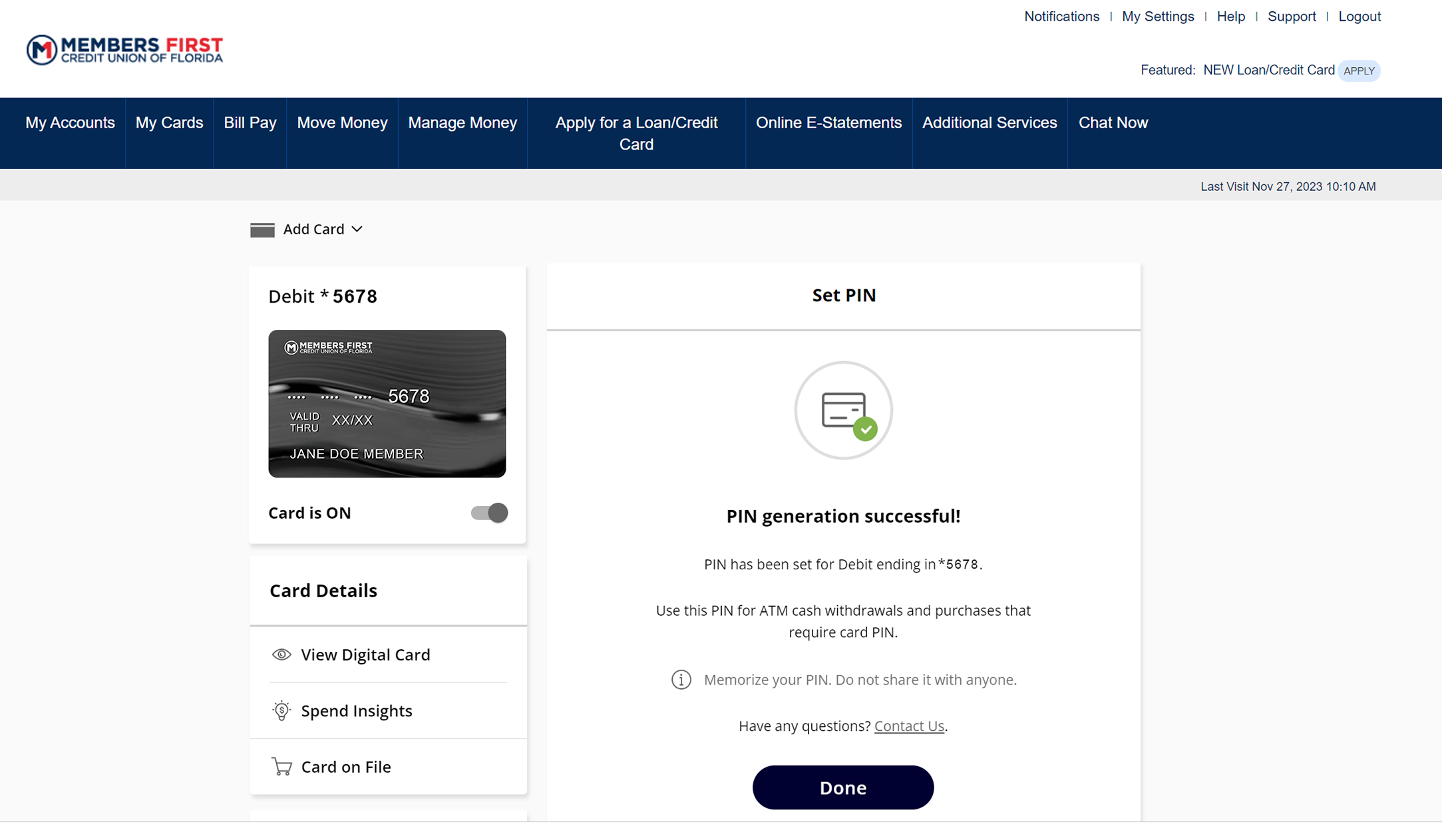

Your PIN has successfully been generated. For your protection, memorize your PIN. Do not write your PIN down or share your PIN with anyone.

RESOURCES

Apple and the Apple logo are trademarks of Apple Inc. registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google Inc.

Depending on your carrier and data service plan, you may incur charges for web enabled features on your device. Check with your mobile service provider for more information.

Go to main navigation