I am reminded of The Sound of Music. The scene where the captain's eldest daughter is under the gazebo waiting for her beloved. When he does finally come, she breaks into song, "I am sixteen going on seventeen...", and then he chimes in, "I am seventeen going on eighteen...", Everything about that scene is so optimistic and lovely because it's pure and a bit naïve. Both characters don't really know what's ahead of them, but they have an ideal picture of what they believe will be their future. Neither of them foresees the road blocks that are potentially going to be in front of them. Now, what does a musical have to do with finances and paying off your loan(s), you might ask? Would I be reaching too much to compare their optimistic attitudes to my own when I was eighteen going on nineteen or even older than that? I don't think so.

Most people have a set of goals they want to achieve. Some people have their goals written out and planned to the t. But, if you're like me, you take things as they come. You have a vague idea of what you want out of life; a college education, a house, a car, a dog or cat, a family, and traveling. How do you get there? In most cases, money lending or loans are involved. It's definitely rare to hear stories about people buying their cars outright, unless they have a lot of money; or, they bought something akin to the 1971 Chevrolet Vega GT in the movie Never Been Kissed; a real clunker. Needless to say, you get what you pay for, but that is beside the point. Having a loan, or several loans, is fairly inevitable. And while most people tend to paint loans as a necessary evil, they don't have to be.

My father's sound financial advice to me as I was growing up centered around four things:

- Save all you can.

- Don't spend more than you have.

- Pay your credit card in full every month.

- Never take out a loan, unless you absolutely have to.

It's the financial code that I live by; and, it was always fairly easy to live by because he helped me so much during my college years. I believe I can speak for the majority when I say, that most people don't have that luxury though, and that's okay. Loans are a fantastic aid for paying for those things you need/want when you don't have all the funds outright or when you want to pay something off in small doses. The thing that makes them evil is when you get behind on payments or bite off more than you can chew. A loan is a tool, not a crutch. So,

1) Know Your Full Loan Amount, Your Monthly Payment Amount, And When Your Loan is Due. Whether you have one loan, or several loans, it's a good idea to keep a notebook or spreadsheet with this information handy. It's also good practice to treat your notebook or spreadsheet like a checking account register. List the date you paid on your loan, the amount you paid, and then subtract that from your total loan balance. Do this for each of your loans, if you have more than one. While this will not show the total amount in interest you'll be paying if you decide to pay your loan off, it will give you a better idea of how much you've paid on it and how much you have left to pay.

2) Don't Forget to Add Your Loan Payment(s) to the Budget. Most everything, money wise, really boils down to this key point. Budget, Budget, Budget. Account for every penny that you earn and every penny that you spend. You know when your loan is due each month and how much you need to pay on it, so it should be natural to include your payment in your monthly budget. It can be hard, especially if money is tight, but what you're really doing is paying yourself. How? For one, if you include your loan payment(s) in your monthly budget, there is less likelihood of your payments being late. The money is there and ready to be applied to your loan. This lessens the chances of having to dish out late fees. Also, interest accrues daily on simple interest loans, with your payment being first applied to interest then to the principal of your balance. So, the more time spent between loan payments means you'll be paying more in interest.

3) Take Advantage of Automatic Payments. Save yourself the hassle of trying to find the time to make a quick run to the credit union by having your loan payment(s) come out automatically. You can set up your payment so it will come out of your account when your loan is due. If you have your paycheck coming into your account automatically, you can have your payments made during your first or second paycheck of the month. You can also make partial payments towards your loan with each paycheck.

4) Pay More Than What's Due. Now, this can be a tough thing to do, especially if you're already running on a tight budget. But, if you have money to spare, why not put an extra $10 or $20 towards your loan? Remember that interest accrues daily, so putting a little extra towards each payment can help to reduce your principal. This means that you'll pay less on interest and further chisel away at your loan balance. You can do this when you make your initial full loan payment for the month, or any time afterwards. If you want the extra payment to go strictly to principal, say so. Otherwise, it will be processed as an extra regular payment with a portion of the payment going to interest. It should be noted that you can only make Principal Only Payments after your regular loan payment has been made.

5) Borrow Only What You Can Afford. So, this is where some smarty pants would say that they wouldn't be borrowing it if they could afford it. Remember that your loan is a tool, and you never want to operate anything that you can't handle. The amount you have to pay on your loan each month (i.e. your loan payment) is based on the amount you are borrowing, your loan term, your total monthly income, and your credit score. Upon applying for your loan, if you find yourself stretched thinner than you'd like money wise, don't do it. If you're flipping burgers, and there is nothing wrong with that (I love burgers and the people that make them), you probably shouldn't be applying for a loan to buy a Ferrari, because chances are, you aren't making enough money.

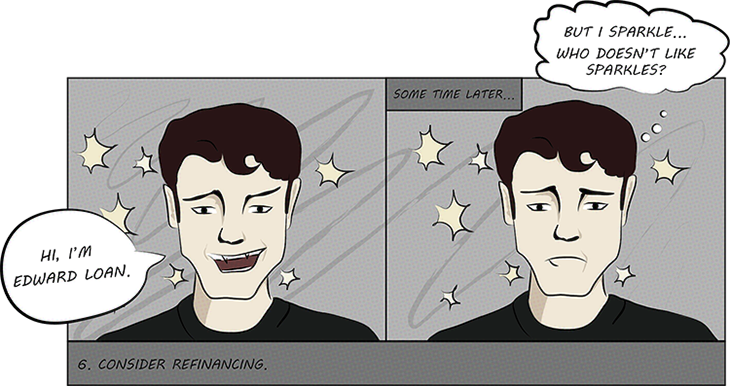

6) Consider Refinancing. There are several reasons to consider refinancing, to name a few:

- Taking advantage of a better interest rate.

- Consolidating loans/debts into one loan. If you have multiple loans/debts, consolidating these into one loan has the potential of greatly reducing the money you owe over time. This can also mean a lower monthly payment.

To view a list of current rates at Members First Credit Union of Florida, Click Here.

7) Know Your Stuff. Know your loan(s). Your loan is probably going to be hanging around for a while, unless you have a small, short-term loan. So get to know it. Know your balance, your payment amount, the APR (Annual Percentage Rate), and when your loan is due. If you do have to pay your loan late, is there a grace period? How long is the grace period? Be familiar with the terms and terminology, as well. The more you know about your loan, the better off you are.

« Return to "BluePrint"